I learned many years ago that the purchase price of a product, service, or technology only amounts to about 1/20th of its lifecycle cost (or cost of ownership over its useful life). This changed my focus from price to lifecycle cost management when deciding to purchase a product, service, or technology.

Purchase Price is Only the Tip of the Iceberg

This is the only true measurement of your total cost of acquisition to disposal for anything you buy. That’s why we like to say, “Purchase price is only the tip of the iceberg.” It’s what’s beneath the surface of the iceberg that you need to be doubly concerned about, not the price at the pump.

Lifecycle Cost Formula

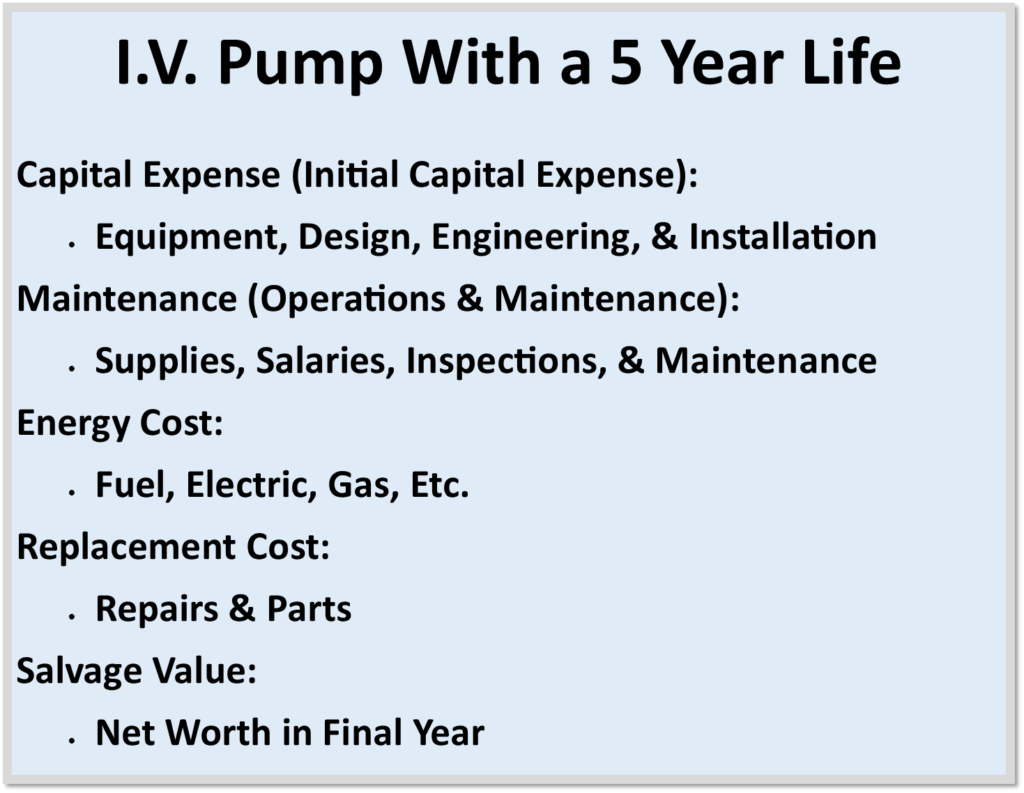

The formula for lifecycle cost is LCC = Cost + Maintenance + Energy + Repairs – Salvage Value, which I have detailed in figure 1. You can imagine that if an I.V. pump cost your hospital $895 or more in acquisition cost, the cost of ownership (i.e., maintenance, operations, energy cost, etc.) over five years could be as high as 10 to 20 times your capital expense. That’s why your acquisition cost has no relationship to your total cost of ownership.

Figure 1

I see this playing out in my own firm’s purchases. A few years ago, I bought a Brother Fax/copier/scanner for $99.00. It’s a great machine, but it cost me $32.49 for an ink cartridge which lasts about six months. Let’s do the math: Six replacement ink cartridge over 3 years = $194.94. So my cost of ownership (with no maintenance issues and minimal energy cost) to date is $293.94. I’m okay with this lifecycle cost since my fax/copying/scanning is very negligible. In my opinion, this was a good purchasing decision for my firm.

Perform a Lifecycle Cost Analysis

However, healthcare organizations are supply and technology intense, unlike my own firm’s expenses. Your hospital’s copier cost alone could amount to $250,000 annually, so you absolutely need to perform a lifecycle analysis even if you lease your copiers. I recently found out that my high-speed copier company has built into my lease an annual increase of up to 5%, and they just increased my cost this year by 1.5%. This should have been factored into my lifecycle cost if I knew it was in my contract. This oversight won’t happen again, since I’m now on to their game.

The Goal of Healthcare Value Analysis Professionals

I think you get the idea! If you think that you are obtaining the “best value” for your healthcare organization by bidding, utilizing GPO contracts, or through negotiations – you’re wrong! “Best value” is a combination of getting the right functions, for the right purpose, along with the lowest lifecycle cost available to you. Then, you will have the lowest cost from acquisition to disposal on everything you buy. Isn’t that the goal of all healthcare value analysis professionals?

Articles you may like:

3 Ways to Get Your Healthcare Value Analysis Projects Approved